Smart Hospitality: How Digital Solutions Elevate Guest Experience and Revenue

Frustrated travelers and long wait times don’t mix. Scala’s self-service car rental kiosks streamline check-in, cut queues, and enhance guest satisfaction.

Frustrated travelers and long wait times don’t mix. Scala’s self-service car rental kiosks streamline check-in, cut queues, and enhance guest satisfaction.

Hotel loyalty apps promise personalized perks, but too often, they fall short on engagement. Despite strong membership numbers, many guests never download or use the app — missing out on tailored offers, streamlined experiences, and exclusive services. Scala helps hotels change that. By integrating dynamic digital signage and self-service kiosks across the property, Scala transforms how and where guests interact with your loyalty program. The result? More app downloads, deeper personalization, and longer, more profitable stays.

Discover how Scala’s digital signage, kiosks, and intelligent media networks transform every step of the hotel guest journey — from seamless check-in to smart upsells — while empowering staff, reducing wait times, and increasing revenue.

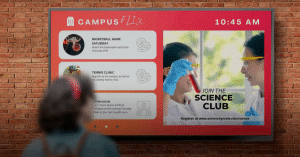

Imagine a high school hallway bustling with students, teachers prepping for their next class, and staff ensuring the day runs smoothly. Amid the noise and movement, an important announcement goes unheard over the PA system, a last-minute schedule change gets lost in a flood of emails and a safety alert struggles to reach everyone in real time.

For years, schools have relied on outdated communication methods — paper notices pinned to bulletin boards, sporadic email updates and hurried PA announcements — leading to confusion, missed messages and disengaged students. In a world where instant information is the norm, schools need a more effective way to connect with their communities.

Scala’s digital signage provides a cutting-edge solution to these communication challenges, enabling schools to streamline messaging, improve engagement and enhance safety measures.

Schools often grapple with fragmented communication systems that make it difficult to reach students, faculty, and parents effectively. Common issues include:

Without a unified communication strategy, schools risk ineffective messaging, leading to missed opportunities for engagement and, in some cases, critical safety concerns.

Scala’s digital signage for education provides a dynamic, scalable solution that transforms how schools communicate. With an intuitive content management system and powerful display capabilities, Scala’s digital signage enables schools to:

By integrating digital signage, schools can unify their communication efforts, making it easier to distribute relevant, engaging and timely messages across the entire campus.

Digital signage helps improve daily communication. It also plays an important role in school safety by sending emergency messages in real time. Schools need to share urgent information quickly and clearly. This helps students, teachers, and staff get clear instructions in critical situations.

Schools that have implemented Scala’s digital signage have seen significant improvements in communication and engagement. For example, The Nest Schools successfully modernized their communication strategy by integrating digital displays to keep parents informed and enhance classroom engagement.

“Two of our main goals were to demonstrate our tech-forward, innovation mindset, and to distinguish ourselves from our competitors,” says Sean Kiner, Chief Information Officer of The Nest Schools. “This important information used to be posted with paper signs. Now, communications are easier to maintain and make a bigger impression with digital signage. We had specific requirements for success and Scala was the company that could make that happen. Every team member was able and willing to customize to our needs.”

Scala’s solution allowed The Nest Schools to streamline messaging across multiple locations, ensuring consistency and efficiency.

Similarly, Wichita State University leveraged Scala’s technology to improve campus-wide communication. Their implementation of digital signage allowed for real-time updates, emergency notifications and an enhanced student experience, demonstrating the scalability of Scala’s solutions for both K-12 schools and higher education institutions.

“We’ve received great feedback from them (Marcus Welcome Center),” says Greg Matthias, Manager of Video Services at Wichita State University. “Students see their names up on the display, and they use those touchscreens heavily. It’s hard to quantify that impact, but we know our work matters.”

As educational institutions continue to embrace technology, how digital signage improves communication in schools becomes increasingly evident. The rise of EdTech and the demand for streamlined, engaging and real-time communication make digital signage a must-have tool for schools of all sizes.

Investing in digital signage for education not only enhances day-to-day communication but also strengthens emergency preparedness, community engagement and school branding. As more institutions look to modernize their approach, Scala’s expertise in digital signage provides a proven path to success.

To see how schools are already benefiting from Scala’s digital signage solutions, check out The Nest Schools case study and discover how your institution can achieve similar results.

The evolution of retail marketing has taken on many forms, but one of the most dynamic developments is the rise of in-store retail media. Some might see it as a glorified version of digital out-of-home (DOOH) advertising—displaying flashy messages on screens within stores—but in-store retail media is far more sophisticated, driven by data, customer interaction, and technology. It’s changing the way brands connect with consumers at the most critical point: when they’re about to make a purchase.

To simply define in-store retail media as DOOH is to ignore its vast potential for personalisation, targeted engagement, and sales optimisation. As we dive into what makes in-store retail media unique, we will discover why it stands leagues beyond traditional DOOH advertising, reshaping the future of retail.

The Power of Personalisation

One of the most striking differences between in-store retail media and traditional DOOH is the ability to personalise content to a greater degree. In-store media can draw on real-time data to target individuals or specific customer segments as they browse. Imagine a shopper moving through the aisles, and the screen beside them highlights a product based on their previous purchases, loyalty card preferences, or even live stock levels in the store. This level of personalisation is impossible with DOOH installations that simply push a message to a broad audience.

The ability to integrate with customer loyalty programmes or mobile apps makes this even more powerful. When brands and retailers can understand not just general foot traffic, but who the specific shoppers are, what their preferences may be, and how they’re interacting within the store environment, they can fine-tune messaging to offer truly relevant promotions. In essence, in-store retail media turns screens into strategic points of engagement, allowing brands to connect with the consumer in a far more relevant and powerful manner than what is possible with DOOH.

Driving the Path to Purchase

In-store retail media does more than simply display ads—it actively influences the purchasing decision. While a static digital sign may attempt to raise brand awareness or reinforce marketing campaigns, in-store retail media offers a fully contextualized journey for shoppers – delivering attributable results and the ability to get analytics from the aisles to better inform future campaigns and prove incremental sales. By strategically placing smart digital screens at key points within the store, such as near product displays or at checkout, brands can deliver relevant messages that complement the shopper journey and have stronger influence.

For example, a customer may be on the fence about buying a particular product, and a nearby screen could highlight a limited-time offer or provide additional information about the product’s benefits. This kind of last-minute influence, right at the point of sale, transforms passive ad displays into active sales drivers. In fact, in-store retail media is more akin to dynamic merchandising, offering a measurable boost to sales, which traditional DOOH cannot achieve in isolation.

Integration with the Digital Ecosystem

In-store retail media bridges the gap between physical retail environments and online marketing strategies. Screens in stores are no longer just outlets for broadcasting ads—they are now integrated touchpoints within a broader omnichannel strategy.

With technologies like data-compliant sensors and real-time data analytics, in-store retail media can garner and use a wealth of in-store customer behavioural data. This data can then be fed back into digital marketing campaigns, enabling retailers to optimise both their in-store and online efforts. For instance, a customer who interacts with a product in-store but does not purchase it could be retargeted with personalised ads online, perhaps through email, social media,mobile app notifications or connected television.

Moreover, in-store retail media can be tied into loyalty programmes and CRM systems, allowing retailers to deliver highly specific, data-driven content that enhances the shopping experience, creating convenience and minimising frustrations for their customers.

Advanced Metrics and Real-Time Feedback

One of the main limitations of DOOH is the difficulty in tracking its effectiveness. While impressions can be roughly estimated based on foot traffic or location, there is little concrete data on how many people actually engage with the ad or how it influences behaviour. In-store retail media, however, offers the possibility of real-time feedback and advanced metrics.

With technologies like RFID, beacons, and customer analytics platforms, retailers can track exactly how many people interact with specific in-store media placements, which products they pick up afterwards, and whether the digital content influenced their purchasing decision. This closed-loop attribution provides a clear understanding of ROI and allows for real-time optimisation of campaigns.

For instance, if a particular promotion isn’t generating the expected engagement, the messaging can be adjusted on the fly to better suit the audience. This ability to measure, analyse, and act on consumer behaviour swiftly sets in-store retail media apart from the more static nature of traditional DOOH.

Creating an Immersive Experience

DOOH typically plays a supporting role in the marketing mix, adding visual presence but rarely creating a fully immersive experience. In-store retail media, by contrast, has the ability to enhance the overall shopping environment, turning it into an interactive and engaging experience. By blending digital signage with interactive displays, touchscreens, and augmented reality, in-store retail media can provide valuable information and entertainment that enriches the customer journey.

Consider a shopper in a clothing store. Instead of simply seeing a screen that shows a rotating set of ads, they might use an interactive display to browse additional product options, check sizes, or even virtually try on items using AR technology. This level of interactivity not only makes the shopping experience more enjoyable but also encourages customers to spend more time in the store and engage with the brand in a more meaningful way. For the retailer and the brands they supply, these interaction provide useful information on how to serve shoppers better in the future.

Successful Retail Media: Beyond Just Screens

In-store retail media is so much more than just another form of digital out-of-home advertising. It represents a powerful, data-driven tool for personalising customer experiences, influencing purchasing decisions, and integrating with the broader digital marketing ecosystem. While DOOH may still play a valuable role in reaching broader audiences, in-store retail media takes things to the next level by creating dynamic, interactive, and measurable touchpoints that can directly impact sales.

As retailers continue to invest in digital transformation, the role of in-store retail media will only become more central to their strategy. Its ability to seamlessly blend the physical and digital worlds, deliver personalised content, and provide advanced metrics makes it a cornerstone of the future of retail. It’s time to stop thinking of it as just another screen and start recognising it as a critical component of a modern, integrated marketing strategy.

This article first appeared in Retail Technology Innovation Hub

DMEXCO 2024 brought together the brightest minds in retail, marketing, and technology, offering a stage for innovative ideas and actionable strategies. Scala’s masterclasses at the event were packed with hundreds of attendees and spotlighted the dynamic evolution of in-store retail media networks (RMNs), focusing on how brands, retailers and agencies can harness data and technology to create compelling, creative marketing campaigns to drive sales and increase revenues.

Here’s a quick recap of the thought-provoking sessions, each addressing critical components of the retail media landscape:

1. From Traditional to Targeted: The Evolution of Agency and Brand Spending

This masterclass explored how agencies and brands are shifting investments towards in-store RMNs and what universal standards are required to allow them to feel confident in making that investment. Read the full breakdown here.

2. From Data to Decisions: Unlocking the Power of Performance Marketing for Measurable Success

Performance marketing has transformed retail, bridging data and actionable strategies to deliver measurable success. Learn how retailers are gathering that data and the way brands are using it here.

3. From Data Collection to Data Security: Balancing Growth and Compliance in Retail

Retailers must strike a delicate balance between leveraging customer data for growth and adhering to stringent data privacy regulations. Dive deeper into this essential topic here.

4. From Clicks to Bricks: Loyalty Programs as the Catalyst for Omnichannel Insights

Loyalty programs provide a rich source of customer insights that can drive both digital and in-store strategies. Explore how they bridge online and offline experiences here.

5. From Linear to Connected: Connected TV Reshaping Retail Media Partnerships

Connected TV is redefining RMNs by enabling seamless integration across channels, expanding reach and relevance. Discover how it’s reshaping partnerships here.

6. From Shared Profits to Owned Platforms: Supercharging by Fusing DOOH and In-Store

Explore the convergence of DOOH and in-store retail media and what makes the two offerings quite separate. Learn about the need for consistent measurement, customer-centric strategies and leveraging data-driven insights to optimise advertising impact and budget allocation. Take a closer look at the fusion of DOOH and in-store retail media here.

What’s Next for RMNs?

DMEXCO 2024 highlighted the pivotal role of in-store RMNs in the modern retail ecosystem, with tools and solutions provided by Scala, Walkbase and others enabling brands and retailers to create personalised, data-driven experiences that resonate with today’s consumers.

The ways in which in-store retail media has transformed retail relationships, marketing structures and customer experience will be explored more deeply in the next “What’s In Store for Retail Media Networks” event, scheduled for January 11, 2025. Held in partnership with the National Retail Federation (NRF), this event is poised to be a cornerstone of NRF 2025: Retail’s Big Show in New York City.

Participants will gain actionable insights from thought-provoking discussions, network with industry leaders, and explore strategies to innovate in this evolving space. Register now for NRF 2025 and secure your spot for the “What’s In Store for Retail Media Networks” event here.

In the sixth masterclass session at DMEXCO 2024, Chris Riegel, CEO and Founder of STRATACACHE, brought together industry leaders to discuss the convergence of digital out-of-home (DOOH) and in-store retail media. As brands and retailers seek to reach audiences effectively along the customer journey, the session explored how these advertising formats could complement each other, shifting from traditional advertising towards more precise and performance-oriented strategies.

Here’s a breakdown of the session’s insights:

Key Differences and Overlaps between DOOH and In-Store Retail Media

The panelists opened by distinguishing between DOOH and retail media, emphasizing how each serves unique purposes. Frank Goldberg, managing director of Germany’s Institute for Digital Out of Home Media, noted that while both use digital screens and similar technology, retail media has unique advantages in shopper marketing and direct conversion due to its in-store presence.

Remon Buter, Chief Investment Officer at GroupM, argued that while retail media can drive conversion at points of purchase, DOOH remains effective in top-of-funnel brand-building efforts. Despite these differences, both channels could benefit from integrating more data to improve targeting and measurement.

Metrics and the Need for Unified Measurement

The discussion highlighted challenges around measuring effectiveness, especially across different European markets. Florian Rotberg, managing director of Invidis Consulting, explained that while Germany has advanced data on DOOH reach and conversion, retailers still seek greater standardization for in-store metrics.

Panelists emphasized that comparing the brand impact of each medium and integrating reach metrics could help retailers and advertisers make more informed buying decisions. As different countries in Europe maintain distinct standards, a pan-European measurement system could help unify these metrics for advertisers.

Shifting Budgets and the Rise of Digital Media

The session examined how budgets are moving from traditional media to digital formats like DOOH and in-store screens. Frank argued that while digital channels grow, traditional TV and print are seeing declines, pushing advertisers to allocate more budget towards DOOH and retail media. Panelists agreed that DOOH’s strength lies in creating brand awareness, while in-store media excels in targeting customers closer to the point of purchase, supporting conversion goals.

Challenges and Opportunities for Retail Media

One significant challenge for retail media is its current reliance on traditional trade marketing budgets, though it’s evolving towards attracting incremental media budgets. Panelists debated whether in-store screens should focus solely on performance or also embrace brand-building.

Frank suggested that in-store screens should avoid being labeled strictly as “performance media,” as this may limit their brand-building potential. Remon added that as retailers grow more comfortable with data-sharing and measurement, they’ll become better equipped to position retail media networks as reliable performance channels.

Future Integration and the Path Forward

Looking ahead, panelists saw significant potential in blending DOOH and in-store media as part of a holistic strategy. By positioning screens strategically along the customer journey—from the street to the store aisle—advertisers can extend brand campaigns and leverage location-specific relevance at the point of sale. With advancements in programmatic buying and data integration, DOOH and in-store retail media networks could soon operate under a unified planning framework, enabling advertisers to reach audiences with precision at every stage of their journey.

Closing Thoughts

As retail media networks continue to expand, they are reshaping the advertising landscape, offering retailers a new revenue stream while enabling brands to reach customers more effectively. The session concluded with a consensus that while DOOH and in-store media serve distinct roles, they can work together in an integrated approach to drive both brand awareness and conversion, ultimately providing advertisers with a more versatile and effective media mix.

This convergence marks a significant evolution in retail advertising, opening new avenues for growth and innovation in digital media strategies across Europe.

You can watch the masterclass here. You can access all of the masterclasses of What’s In-Store for Retail Media Networks, presented in cooperation with DMEXCO here.

This September Ben Reynolds, Vice President Of Business Development, Walkbase chaired a panel discussion on loyalty data as part of Scala’s What’s in Store for Retail Media Networks, presented in cooperation with DMEXCO. You can see the full session here and read a summary of the topics raised here.

One of the panelists, retail consultant and strategist, Renee Hartmann sat down with Ben to discuss the value of first party data and how the future of retail belongs to those who make customer service a priority. The article below originally appeared on renee-hartmann.com.

“First-party data is your most valuable asset—be diligent and transparent in how you use it,” emphasizes Ben Reynolds, VP of Business Development at Walkbase, setting the tone for our recent discussion on the evolution of retail engagement strategies.

After I had the pleasure of participating in a panel moderated by Ben Reynolds, Vice President of Business Development at Walkbase, at DMEXCO on customer loyalty, I flipped the script to unpack his insights on building lasting customer loyalty in today’s retail landscape.

In today’s retail landscape, the ability to harness first-party data has become crucial for creating meaningful customer experiences – especially as consumers shop across channels. Reynolds notes that retailers are becoming more sophisticated in their approach, particularly in North America, where companies are effectively leveraging behavioral data from e-commerce sites to enhance personalization and loyalty programs.

However, a significant challenge remains: bridging the online-offline divide. While many retailers successfully track transactions and link them to online behavior, they often miss valuable in-store behavioral data. “What if I don’t transact, but I’m showing intent like I do on a website?” Reynolds points out, highlighting an often-overlooked opportunity in physical retail spaces.

Innovation in Customer Engagement

Leading retailers are finding creative solutions to this challenge. Some are implementing sophisticated tracking systems for shopping carts and baskets, while others are focusing on mobile engagement. Companies like IKEA and Starbucks exemplify successful approaches in bridging the gap through mobile apps, creating seamless experiences that incentivize customers to engage across channels.

“Your own properties—site, store, mobile—are your most powerful channels for direct customer communication,” Reynolds emphasizes. “So be sure to invest in reaching your customer on your own sites, especially as the cost-curve for in-store retail media assets comes down, and retail media margins remain high.”

The key to successful data collection lies in creating a clear value exchange. Whether it’s Starbucks’ loyalty program or Sam’s Club’s scan-and-go technology, customers are willing to share their data when they receive meaningful benefits in return. These might include personalized offers, enhanced convenience, or exclusive perks.

The Role of AI in Retail Evolution

Artificial Intelligence is revolutionizing how retailers process and utilize customer data. With millions of daily observations from both physical and digital channels, AI enables retailers to:

Retailers are increasingly turning to AI across all aspects of their business that enable them to unlock more sophisticated consumer insights, quickly personalize the customer experience based on these insights, and tailor content specifically to each individual’s preferences.

Looking Ahead

As the retail landscape continues to evolve, success will depend on thoughtful deployment of first-party data strategies. Reynolds advises retailers to:

The future of retail belongs to those who can effectively balance these elements while maintaining customer trust and delivering genuine value. As technology costs decrease and retail media margins remain strong, now is the perfect time for retailers to invest in strengthening their omnichannel presence.

In the fifth masterclass session at DMEXCO 2024, panelists discussed the growing significance of Connected TV (CTV) as a strategic advertising tool for retailers. The session, hosted by Chris Riegel, CEO and Founder of STRATACACHE, featured industry leaders such as Jay Rajdev from ITV, Claire Hunt, Director of Atonik Digital and former Senior Partner Manager at Amazon Prime Video Channels, and Christian Zimmer, Managing Director at Teads.

These industry experts explored how retailers and media networks can leverage CTV for targeting precision and greater revenue impact, especially as traditional TV ad spending shifts towards digital formats. Here are the highlights of the session:

The CTV Advantage for Retailers

CTV emerged as a core component for retail media networks, providing retailers with an additional advertising channel to complement on-site, in-app, and in-store strategies. The shift of advertising to CTV not only offers increased targeting accuracy but also ensures a more seamless viewer experience without interrupting content, enhancing both ad relevance and viewer satisfaction. By integrating retailer data with CTV platforms, advertisers can deliver highly-personalized ads, which improves the return on ad spend while offering meaningful insights on in-store conversions.

Evolving Consumer Habits: The Role of Data and Streaming

Speakers stressed the importance of data-driven strategies in an environment where consumers increasingly opt for on-demand, multi-platform viewing. Jay from ITV UK shared that over half of the world’s TV screens are now internet-connected, enabling new data integrations and targeted advertising beyond traditional demographics. He highlighted how ITV’s proprietary streaming platform, ITVX, was designed to capitalize on this trend, offering advertisers targeted reach with enhanced viewer insights.

Navigating Regional Nuances in CTV Adoption

Panelists noted that CTV adoption varies by region, with the US leading the shift from linear TV to streaming, while markets like the UK and Germany retain significant linear viewing bases. In Germany, strict GDPR regulations present unique challenges to data sharing, often necessitating innovative approaches for compliant audience targeting. Meanwhile, in the UK, public service broadcasting continues to drive high engagement, making it essential for broadcasters to balance traditional linear advertising with emerging CTV capabilities.

Democratizing Advertising for Smaller Brands

A key discussion point was the potential for CTV to “democratize” advertising. With highly-targeted CTV capabilities, brands with smaller budgets can now compete for premium ad placements alongside large FMCG brands. This development enables mid-tier brands to engage consumers with greater cost efficiency than traditional TV could allow.

Data Collaboration and Consent Challenges

The panelists emphasized the critical role of data-sharing partnerships between retailers and media networks. By merging retailer data with media consumption habits, advertisers can create shopper graphs that link online engagement with offline purchasing behaviors. However, ensuring consumer consent and addressing GDPR compliance are ongoing hurdles, particularly in regions with stricter data regulations. Claire Hunt from Atonik Digital noted that while consumer targeting precision offers clear benefits, transparency and robust consent mechanisms are key to sustaining consumer trust.

Towards a Unified Approach for Retail Media Networks

In concluding remarks, speakers encouraged retailers to embrace CTV as a cornerstone of their media strategies, despite the nascent state of standardized technologies and consent frameworks. They highlighted the importance of curiosity, experimentation, and adaptability for retailers entering this space, stressing that the future of advertising lies in collaborative, data-driven, and highly targeted approaches.

The consensus was clear: CTV offers retailers unprecedented precision in reaching consumers, with the potential to transform retail advertising. As the sector continues to innovate, the value proposition of CTV will only grow, making it a pivotal tool for any retailer looking to enhance customer engagement and drive measurable outcomes.

You can watch the masterclass here. You can access all of the masterclasses of What’s In-Store for Retail Media Networks, presented in cooperation with DMEXCO here.

This week our sister company, PRN, announced that they would be responsible for the monetization of all digital in-store advertising space for Basic-Fit in France. PRN will run the French on-premises media network for Europe’s largest fitness chain from January 1, 2025 placing advertising across more than 5,000 displays, combining to an annual rate of over 110 million impressions. You can read the full press release here.

This partnership is the first European retail media network to be operated by PRN, which is, like Scala, a STRATACACHE company. PRN has 30 years of success in architecting, deploying, and monetizing multi-stakeholder, rich-media networks, primarily in the US.

This is an exciting announcement for Scala. We have been working with Basic-Fit since 2012, providing the display infrastructure crucial to Basic-Fit’s customer and employee communications strategy. Scala also powers the Basic-Fit “Virtual Cycling” and “Virtual Workout” experiences, through which members can access fitness classes remotely across the Netherlands, Belgium, Luxembourg, France, Spain, and Germany.

The PRN announcement demonstrates the strength of the STRATACACHE proposition regarding retail media networks. By working with the STRATACACHE family of leading marketing technology companies, including Scala, PRN, and Walkbase, retailers and business owners can create and optimize an in-store retail media network that generates revenue through targeted messaging delivered on premier display technology. The customer behavior data available through the Walkbase analytic tools means that the impact of the retail media network can be accurately demonstrated and appropriately monetized.

I’m immensely proud that our relationship with Basic-Fit has evolved the way that it has. The Scala team has worked closely with Basic-Fit over the last 12 years to ensure that they can offer their customers, employees and partners an incomparable experience. The flexibility of the Scala platform has meant that the customer-facing capabilities of the technology within Basic-Fit clubs has steadily grown. New opportunities such as the Virtual Fitness Experience, showcase the innovation, creativity and trust that have guided our ongoing relationship with Basic-Fit. That Basic-Fit are now deepening their commitment to STRATACACHE by appointing PRN to manage their French retail media network demonstrates the expertise of the STRATACACHE family of marketing technology companies when it comes to working with businesses to create efficiencies and extend revenue opportunities. I am excited to see how the partnership develops and to share many similar announcements in the future.