The evolution of retail marketing has taken on many forms, but one of the most dynamic developments is the rise of in-store retail media. Some might see it as a glorified version of digital out-of-home (DOOH) advertising—displaying flashy messages on screens within stores—but in-store retail media is far more sophisticated, driven by data, customer interaction, and technology. It’s changing the way brands connect with consumers at the most critical point: when they’re about to make a purchase.

To simply define in-store retail media as DOOH is to ignore its vast potential for personalisation, targeted engagement, and sales optimisation. As we dive into what makes in-store retail media unique, we will discover why it stands leagues beyond traditional DOOH advertising, reshaping the future of retail.

The Power of Personalisation

One of the most striking differences between in-store retail media and traditional DOOH is the ability to personalise content to a greater degree. In-store media can draw on real-time data to target individuals or specific customer segments as they browse. Imagine a shopper moving through the aisles, and the screen beside them highlights a product based on their previous purchases, loyalty card preferences, or even live stock levels in the store. This level of personalisation is impossible with DOOH installations that simply push a message to a broad audience.

The ability to integrate with customer loyalty programmes or mobile apps makes this even more powerful. When brands and retailers can understand not just general foot traffic, but who the specific shoppers are, what their preferences may be, and how they’re interacting within the store environment, they can fine-tune messaging to offer truly relevant promotions. In essence, in-store retail media turns screens into strategic points of engagement, allowing brands to connect with the consumer in a far more relevant and powerful manner than what is possible with DOOH.

Driving the Path to Purchase

In-store retail media does more than simply display ads—it actively influences the purchasing decision. While a static digital sign may attempt to raise brand awareness or reinforce marketing campaigns, in-store retail media offers a fully contextualized journey for shoppers – delivering attributable results and the ability to get analytics from the aisles to better inform future campaigns and prove incremental sales. By strategically placing smart digital screens at key points within the store, such as near product displays or at checkout, brands can deliver relevant messages that complement the shopper journey and have stronger influence.

For example, a customer may be on the fence about buying a particular product, and a nearby screen could highlight a limited-time offer or provide additional information about the product’s benefits. This kind of last-minute influence, right at the point of sale, transforms passive ad displays into active sales drivers. In fact, in-store retail media is more akin to dynamic merchandising, offering a measurable boost to sales, which traditional DOOH cannot achieve in isolation.

Integration with the Digital Ecosystem

In-store retail media bridges the gap between physical retail environments and online marketing strategies. Screens in stores are no longer just outlets for broadcasting ads—they are now integrated touchpoints within a broader omnichannel strategy.

With technologies like data-compliant sensors and real-time data analytics, in-store retail media can garner and use a wealth of in-store customer behavioural data. This data can then be fed back into digital marketing campaigns, enabling retailers to optimise both their in-store and online efforts. For instance, a customer who interacts with a product in-store but does not purchase it could be retargeted with personalised ads online, perhaps through email, social media,mobile app notifications or connected television.

Moreover, in-store retail media can be tied into loyalty programmes and CRM systems, allowing retailers to deliver highly specific, data-driven content that enhances the shopping experience, creating convenience and minimising frustrations for their customers.

Advanced Metrics and Real-Time Feedback

One of the main limitations of DOOH is the difficulty in tracking its effectiveness. While impressions can be roughly estimated based on foot traffic or location, there is little concrete data on how many people actually engage with the ad or how it influences behaviour. In-store retail media, however, offers the possibility of real-time feedback and advanced metrics.

With technologies like RFID, beacons, and customer analytics platforms, retailers can track exactly how many people interact with specific in-store media placements, which products they pick up afterwards, and whether the digital content influenced their purchasing decision. This closed-loop attribution provides a clear understanding of ROI and allows for real-time optimisation of campaigns.

For instance, if a particular promotion isn’t generating the expected engagement, the messaging can be adjusted on the fly to better suit the audience. This ability to measure, analyse, and act on consumer behaviour swiftly sets in-store retail media apart from the more static nature of traditional DOOH.

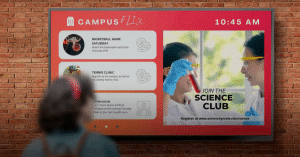

Creating an Immersive Experience

DOOH typically plays a supporting role in the marketing mix, adding visual presence but rarely creating a fully immersive experience. In-store retail media, by contrast, has the ability to enhance the overall shopping environment, turning it into an interactive and engaging experience. By blending digital signage with interactive displays, touchscreens, and augmented reality, in-store retail media can provide valuable information and entertainment that enriches the customer journey.

Consider a shopper in a clothing store. Instead of simply seeing a screen that shows a rotating set of ads, they might use an interactive display to browse additional product options, check sizes, or even virtually try on items using AR technology. This level of interactivity not only makes the shopping experience more enjoyable but also encourages customers to spend more time in the store and engage with the brand in a more meaningful way. For the retailer and the brands they supply, these interaction provide useful information on how to serve shoppers better in the future.

Successful Retail Media: Beyond Just Screens

In-store retail media is so much more than just another form of digital out-of-home advertising. It represents a powerful, data-driven tool for personalising customer experiences, influencing purchasing decisions, and integrating with the broader digital marketing ecosystem. While DOOH may still play a valuable role in reaching broader audiences, in-store retail media takes things to the next level by creating dynamic, interactive, and measurable touchpoints that can directly impact sales.

As retailers continue to invest in digital transformation, the role of in-store retail media will only become more central to their strategy. Its ability to seamlessly blend the physical and digital worlds, deliver personalised content, and provide advanced metrics makes it a cornerstone of the future of retail. It’s time to stop thinking of it as just another screen and start recognising it as a critical component of a modern, integrated marketing strategy.

This article first appeared in Retail Technology Innovation Hub